The highly professional, low-cost investment options we offer LCMS ministries quite often outperforms funds managed by commercial companies.

Using NEPC as our investment advisor and 12 industry-leading fund managers, the Foundation stewards nearly $1.7 billion in investments entrusted to us by 640 LCMS ministries.

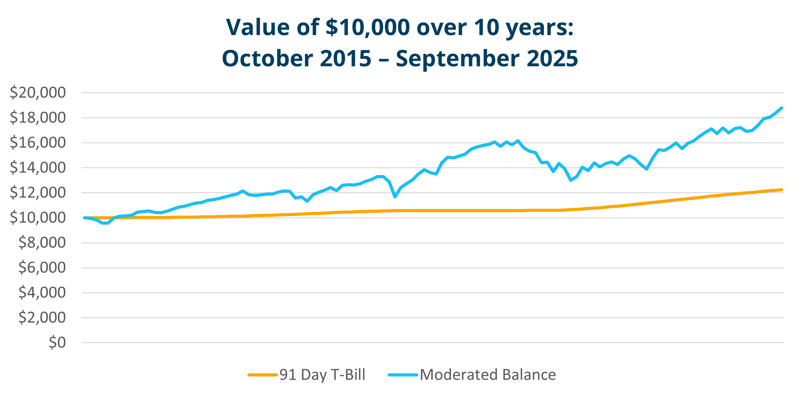

The graph and table below show two examples of how the LCMS Foundation's funds perform compared to alternatives. For detailed monthly, quarterly or annual returns, scroll to the bottom of the page.

Ministries often have significant funds in a local bank account and ask about the value of investing those funds in the market. Below, we compare a hypothetical investment of $10,000, invested in our standard moderate and our aggressive balanced funds, versus a 91-Day Treasury Bill (a good stand-in for investing in a local bank).

The Foundation’s investment committee meets monthly to review the long and short-term investment results for each of the Foundation’s external fund managers and all investment funds offered to account holders. In addition, NEPC prepares a monthly report comparing the Foundation’s investment performance to market norms.

The Foundation Board of Trustees’ investment committee meets quarterly with NEPC and Foundation staff to review investment performance and to consider any possible changes to the portfolio. In addition, NEPC prepares a report each quarter summarizing performance and portfolio returns and holdings.

The Foundation staff meets with each of our external fund managers to review fund performance and adherence to investment guidelines. The Foundation Board of Trustees also reviews our Investment Policy Statement annually, modifying it as needed. We also publish an Annual Performance Summary at the end of each Fiscal Year.

In today’s busy world with volatile markets, we appreciate the expertise and cost efficiency of the Foundation to manage the congregation’s investments. Partnering with the LCMS Foundation provides for not only the ministries of Immanuel, but for the ministries of the church at large.

Bob Wurl

Chairman, Immanuel Endowment Fund Committee

Hankinson, North Dakota

Our school was blessed with our first gift from a donor who wanted to start an endowed scholarship fund. The LCMS Foundation helped guide us through the process of creating an investment fund that reflected the donor’s wishes and provided an opportunity for future financial growth for our school. We were thankful to work with a trusted partner who understood the importance of incorporating our mission and vision in our financial planning.

Jen Pawlitz

Director of Mission Advancement, Christ Community Lutheran School

St. Louis, Missouri

Our partnership with the LCMS Foundation has been a tremendous blessing. In just a few years, we’ve identified more than $20 million in gifts planned for St. Peter and other Lutheran ministries.

Rev. Micah Greiner

Lead Pastor, St. Peter Lutheran Church

Arlington Heights, Illinois

Working with the LCMS Foundation has not only been stress-free but immensely beneficial for our congregation. We are thankful to have a partner in our investing that cares deeply about the proclamation of the Word of God, the administration of Christ’s sacraments, and the congregations of the Lutheran Church – Missouri Synod. The endowment we have started is meant to support these important things in Montana no and for future generations.

Rev. Ryan Wendt

Christ the King Evangelical Lutheran Church

Billings MT

If you're a current account holder or investor with a question, or if you're new to the LCMS Foundation and would like more information, we'd love to hear from you. Please use the "I have a question or comment about" drop-down field in the form below to get your comment to the correct person faster.